How To Teach pocket option best indicator Like A Pro

Transform Investments: Unveiling Quantum AI Trading Platform

To buy stocks online with a broker, follow these steps. The platform utilizes cutting edge AI algorithms to analyze market trends, predict potential price movements, and optimize trading strategies. Get tight spreads, no hidden fees, access to 12,000 instruments and more. In conclusion, traders can use several fundamental strategies that have low risk in place of the high risk that is typically associated with options. Rgb0,0,0,0 Returns: values rgbhsv r, g, b, t RGB Color to HSV. It’s a fantastic read for people interested in the question of whether markets can be predicted and comes to some startling and hotly debated conclusions. MarketBulls Weekly Newsletter. This is because while their system may be appealing, it isn’t based on your personal beliefs about the market. In such situations, developing a new plan or alternative plan may be prudent.

Stock Trading

Our Goods and Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Traders who use a scalping strategy place very short term trades with small price movements. Each brokerage platform charges different fees but, aside from commissions, investors should look at per contract fees for options, brokerage assisted trades, management or advisory fees and transfer fees when switching brokerages. Number of cryptocurrencies offered: 350+. They are also focused on trades that project a good risk reward ratio. Aashika is the India Editor for Forbes Advisor. Do you have a trading plan. Charles Schwab has a long pedigree of helping individual investors, and that tradition remains firmly intact. The pattern gets complete when the price breaks above the resistance level that connects the highs of the handle and the cup.

Best Stock Trading App for Experts

We also look for a fluid user experience moving between mobile and desktop platforms, where offered. This is https://pocket-option-br.online/apple-shares exactly how I always envisaged automated trading to be. WhatsApp: Click here to chat to us on our official WhatsApp channel, 10am to 7pm UTC+10, Monday to Friday. For example, say a day trader has completed a technical analysis of a company called Intuitive Sciences Inc. Since 2009, we’ve helped over 20 million visitors research, compare, and choose an online broker. OnSoFi Active Investing’sSecure Website. In June 2024, IG, our best overall forex broker, packaged its top tier pricing, trading technology, user experience, regulatory support, and research when it launched tastyfx its new standalone brand designed specifically for U. Similarly, if a company reports disappointing earnings and results, its stock usually gets a beating and plummets. From the following Balances of Jayashri Traders, you are required to prepare Trading Account for the year ended 31/03/2019. After a strong downtrend, the Market bounces higher. US provides access to countless more cryptocurrencies, from mainstays like bitcoin and Ethereum to dozens of lesser known altcoins. One of the ways scalping works is by exploiting the bid ask spreads. 12088600 NSDL DP No. Line charts are used to identify big picture trends for a currency. Now, let’s say a call option on the stock with a strike price of $165 that expires about a month from now costs $5. Here comes the role of trading indicators for options. Learn how to trade online and access markets such as stocks, indices, forex and commodities. Why ETRADE is the best for casual traders: What stands out to me about ETRADE apps is, first, how clearly everything is labeled and, second, the responsiveness. Private hedge fund managers and high net worth money managers get even higher salaries. At first, only a few people do it eat it, make it, try it, whatever, and then celebrities and famous figures step in, and before you know it, everyone gets hopped up on this new trend. The initial bearish candle represents a period of selling pressure, but the subsequent bullish candle that opens below the previous candle’s low and closes above its midpoint indicates a strong resurgence of buying interest. Fees may vary depending on the investment vehicle selected. Before launching his own firm in 2018, Thanasi served as the executive vice president and senior wealth advisor at Pathlight Investors while the company oversaw $300 million of individual and family assets. Conversely, larger tick sizes might reduce liquidity by creating wider spreads and less frequent price changes, but they can help highlight significant market trends and reduce trading noise. 2 Outstanding Wages ₹ 500.

EToro: Best for Cryptocurrency Trading

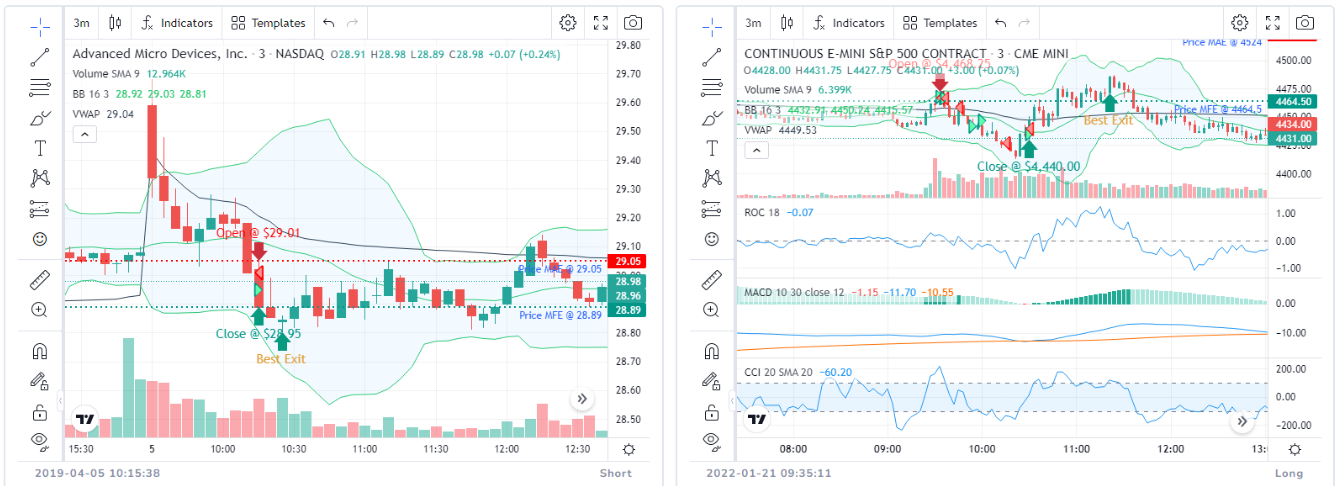

Learn “Advanced Techniques in Day Trading” here. 6 trillion worth of forex transactions every single day. Wide variety of payment systems with zero commission. CFDs are complex instruments. As you become more familiar with the platform, you can start investing in rarer and more valuable colors. To deal with the issue, in 2010 the NFA required its members that deal in the Forex markets to register as such i. It’s important to note that some crypto exchanges have had issues with these secondary services. Mon to Fri: 8 AM to 5:30 PM. Make sure you know your basic order types, though most brokers have more complex options than just these two. While trend traders focus on the overall trend, range traders will focus on the short term oscillations in price. Day traders will buy and sell multiple assets within the trading day, or sometimes multiple times a day, to take advantage of short term market movements. Trade is the process of buying or selling goods and services in exchange for money. However, as they are decentralised, they tend to remain free from many of the economic and political concerns that affect traditional currencies. Lee Freeman Shor’s “The Art of Execution” focuses on the critical aspect of execution in trading. The gap and go strategy involves finding stocks that do not have any pre market volume. MT4 seems to be the most commonly used with multiple prop firms, which is why I use and recommend it. Most financial advisors recommend having the majority of your investment portfolio be in well diversified funds, and then purchasing individual stocks with a small portion of your portfolio. Options priced above ₹3 typically have a tick size of ₹0. And trading speeds are fast. You should also learn by using the paper trading function that many of the top platforms now offer. Colour trading presents a deceptive allure of easy money in the financial markets. After opening the app, you can log in to your forex account and begin trading from your phone. The descending triangle pattern is a chart formation used in technical analysis, typically appearing after an existing downtrend.

Different Types of Crypto Exchanges

“Margin Rules for Day Trading. Superior trading platforms for all types of investors. ” We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information and latest updates regarding our products and services. There’s no one size fits all approach to trading. This means that you are able to practice trading in real market conditions for free. Because the market is open 24 hours a day, you can trade at any time of day. Huge portfolio of both local and international stocks. Please keep me updated on Trade Nation’s sponsorships, news, events and offers. Can I trade stocks with options. But what really sets Bybit apart is their commitment to security and customer support. Ally Invest, Charles Schwab, ChoiceTrade, ETRADE, eOption, eToro, Fidelity, Interactive Brokers, J. A great account for all types of traders, with floating FX Spreads from 1. In this article, we will break down the basics and give you a tip for a complete trading strategy.

IQ Option

It provides modeling that surpasses the best financial institutions in the world. Readers are encouraged to conduct their own due diligence. From our live test on the Standard account, I found that the live spread for EUR/USD during the London and New York sessions averaged 0. Please read our disclaimers, risk warning/disclosures, terms of business and associated documentation here. Some celebrities and high profile individuals have been vocal about how they have made a lot of money in day trading. Liars Poker by Michael Lewis. If you are just getting started, educational materials and training could be quite useful. There are lots of different currency pairings out there like GBP/USD or EUR/USD, and high market liquidity makes it easy for currencies to be bought and sold. It will be even more difficult to introduce necessary changes if you do not have a possibility to look at the gained experience and to objectively assess the efficiency of your plan, degree of its realization and the market you trade in. There’s no cost to open an account with these brokers and no minimum deposit, so go for it. Furthermore, AI investing bots can offer insights to money managers on gaps in their portfolios, informing them how to better balance them. Some of the most popular support and resistance indicators are. Did you know that 90 per cent of individuals who trade leveraged markets end up broke or, at best, break even. Learning and Education.

How can I combine candlestick patterns with other technical analysis tools?

Advanced trading and analysis on mobile. The most basic use of an RSI is as an overbought and oversold indicator. Please do not share your personal or financial information with any person without proper verification. You can even copy traders on eToro. An easy to read and updated guide to the dynamic world of options investing. Once a cup is completed, the handle is formed on the right side of it. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed. Bajaj Financial Securities Limited or its associates may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months. Market data provided by Xignite, Inc. Step 7: Start Trading. In addition, we’ll do our best to reward the most helpful users. Option buyers who pay the premium receive the right, but not the obligation to buy or sell 100 shares of the underlying investment at a set price called the strike price, on or before the expiration date of the contract from the writer/seller. That doesn’t mean day trading is inherently a bad thing — if you have leftover “play money” after paying your bills and meeting your savings goals, and you want to try your hand at day trading with the knowledge that you might lose that money, that’s fine. 50 per contract, less than most of the industry. CMC Markets’ commitment to offering a broad range of trading instruments, combined with its focus on competitive pricing and comprehensive analytical tools, solidifies its position as a preferred choice for day traders. Then, based on your frequency and other requirements such as the need of a Relationship Manager, educational content etc.

What is index trading?

Please stay focused on TradingView topics, education and platform feedback. You could end up buying at a higher price or selling at a lower price than you’d want. HFT is actually a form of algorithmic trading, and it’s characterized by extremely high speed and a large number of transactions. The Double Bottom predicts a change in direction and possibly the start of a new uptrend. However, it’s definitely not for beginners. But the process will depend on your experience in the industry. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w. This can lead to wasting months, or even years trying to find the “holy grail style,” which does not exist by the way. If so, then there are two possible outcomes. For example, a bullish chart pattern signals that it’s a good time to buy a particular asset, while a bearish chart pattern indicates that it’s time to sell or take a short position. No uncertainty about the refund as the money is safe in the investor’s account. Westend61 / Getty Images. In this way, paper trading isn’t only for new traders. Double top and bottom analysis is used in technical analysis to explain movements in a security or other investment, and can be used as part of a trading strategy to exploit recurring patterns. McMillan explains basic concepts before moving to more complex strategies, making it suitable for all levels. These programs analyze market data, execute trades, and manage risk based on predetermined algorithms. P Nagar 4th Phase, Bengaluru 560078, Karnataka, India. The basic strategy of trading the news is to buy a stock which has just announced good news, or short sell on bad news. However, note that our margin policy doesn’t guarantee against your capital running into a negative balance, depending on region and account type retail or professional. 9 Tax laws are subject to change and depend on individual circumstances. Most brokerage accounts are protected by the Securities Investor Protection Corporation, or SIPC. With minimal to no code changes, move from research to point in time, fee, slippage, and spread adjusted backtesting on lightning fast cloud cores. It’s important to continuously evaluate and refine your strategy based on market conditions and your own trading experience. Once you switch to a live account with a much lower account balance, you might feel emotionally desensitized to relatively smaller losses. Clients are requested to note that, Bajaj Financial Securities Limited will not be responsible for any inconvenience caused to clients due to delay in release of funds payout, including fines, delayed charges, defaults, etc. The Impact app focuses on ESG environmental, social and governance investing. Analyze the Option Chain for NSE, BSE, and MCX indices and commodities including NIFTY, BANKNIFTY, FINNIFTY, SENSEX, BANKEX, CRUDEOIL, NATURALGAS, GOLD, and SIL.

Bear Trap Example 1

Develop and improve services. Below is an example to help you understand how trading works. Day trading can be profitable, but it’s far from guaranteed. Let us take you through different formats of the profit and loss account. Making consistent day trading profits is challenging. Any references to past performance, historical returns, future projections, and statistical forecasts are no guarantee of future returns or future performance. Price action is often depicted graphically in the form of a bar chart or line chart. Bullish reversal candlestick chart pattern. The good news is you don’t need a corner office on Wall Street to join the action. The value of these derivatives can be affected by various factors, including market volatility, changes in interest rates, and fluctuations in currency exchange rates. HomeBlogPortfolioAbout UsGlossaryScam AlertPrivacy PolicyContact Us. Views may not be representative, see more reviews at the App Store and Google Play Store. He’s an established investor, bestselling author, and economist with an uncanny ability to foresee how new breakthroughs will play out, years in advance. ” The Double Bottom Pattern is considered a bullish reversal pattern because the Pattern is initiated by a downtrend and finalized in an uptrend. Check out what fellow Algo traders have to say about Tradetron.

Offices

“I’ve used Interactive Brokers for five years, as my advisor uses it to manage my SMA Separately Managed Account the advisor manages the trades in this account on my behalf, and overall I think it has improved a lot in that time. Any swing trading system should include these three key elements. Cryptocurrency data provided by CryptoCompare. During these trading hours, traders have the option to buy, sell, modify, or cancel an existing order without limitations. The best trend indicators are moving averages and Bollinger Bands. Secrets and strategies for the post work life you want. Technical analysis evaluates the stock based on its past price and volume chart to predict future potential. Webull is an excellent choice for beginning and intermediate traders. Best for: Beginners eager to start trading crypto algos with minimal complexity. While the short call loses $100 for every dollar increase above $20, it’s totally offset by the stock’s gain, leaving the trader with the initial $100 premium received as the total profit. Following strike parameter is currently applicable for options contracts on all individual securities in NSE Derivative segment. Day trading also carries a higher level of risk due to the fast paced nature of the strategy. Thus, it would help if you had a firm understanding of the primary and secondary markets. Apple IOS and Android. Options Trading Crash Course by Frank Richmond.

EXAMS

» View our list: The best performing stocks this year. Eastern time on non holiday weekdays. In virtual office address service and I am thoroughly impressed. Founded in 2004 and headquartered in Warsaw, Poland, XTB is a favorite broker among cost conscious forex traders. An Initiative of GTF https://pocket-option-br.online/ Institute Pvt. Sharvani Thakur 30 Apr 2022. I agree to terms and conditions. Meetings with broker teams also took place throughout the year as new products rolled out. This is a preferred strategy for traders who own the underlying asset and want downside protection. A good rule is limiting any trade to less than 20% of your total drawdown. 5+ million clients and 100+ international awards are proof of our success. This strategy is considered a great option buying strategy. In addition to these technical indicators, traders also use chart patterns to identify potential trading opportunities. What are the requirements to trade options. Prices tend to bounce off the bands, especially in a ranging market. Your source for accessible trading insights and smarter investments. Learn top strategies employed for day trading. When two major financial centers are open, the number of traders actively buying and selling a given currency greatly increases. It empowers them to make informed decisions about where to allocate their money, how to diversify their investments to mitigate risk, and potentially grow their wealth over time through sound investment choices.

Bonus Shares: Definition, Types, Advantages, and Disadvantages

Get the link to download the App. Also, as this style involves quick buying and selling, this is usually suitable for traders with small capital. However, it is important to note that these also come with their own set of terms and conditions that one should understand before doing anything else. A stroke of bad luck can sink even the most experienced day trader. Brokerage will not exceed the SEBI prescribed limit. And since uncertainty is the only thing that’s certain about the markets, you should learn to identify the possible scenarios and prepare contingencies for them. Supporting documentation for any claims, if applicable, will be furnished upon request. For new crypto investors, finding a centralized exchange with a friendly user interface and easy deposit experience makes for an easy experience. This eliminates any challenges you may have in analytical and trading activity. That’s why knowledge of technical analysis tools is also vital. Trendlines are important in identifying these price patterns. Trading Futures and Options FandO is subject to market risk. Use automated tools to invest regularly. Intraday trading is a dynamic and potentially profitable trading style, but it requires a thorough understanding of market behaviour, technical analysis, and effective risk management. Choosing a trading account backed by excellent customer support service is highly recommended. The pattern consists of two or more candles with equal or identical lows forming a horizontal support level. The best trading quotes not only provide inspiration but also emphasize the importance of finding a trading method that aligns with your personality and goals. Crucial for liquidity and efficient trading. Rokadimal paid Rs 11,500 for carriage. Seeking guidance from experienced traders can help shorten the learning curve and improve trading performance. INR 0 brokerage for life. “Capital Gains and Losses. On the flip side, traders at premium banks, such as Bank of America and Morgan Stanley earn around $280,000 per year on average. “OANDA”, “fxTrade” and OANDA’s “fx” family of trademarks are owned by OANDA Corporation.

Blog

On top of its vast offering of tradable cryptocurrency products, the eToro app stands out in the fee department. You may also consider adding alternative investments to your portfolio such as real estate or commodities as a way to diversify your investments. Day traders care little about the inner workings of the businesses. ” The strike price refers to the price at which the underlying security can be bought or sold exercised in your options contract. Please enter your name. You can either buy shares directly outright or you can trade them via spread bets and CFDs. They must filter market data to work into their software programming so that there is the lowest latency and highest liquidity at the time for placing stop losses and/or taking profits. Or read our Kraken review. Important concepts and features: The gap is not mandatory and the candle sequence is the key to this pattern. For that reason, most educators try to condense the types of candlestick patterns into the most popular ones. Use profiles to select personalised advertising. If a 50 day MA crosses the 100 day MA and moves upwards, it could signal the start of a bullish trend. With two decades of business and finance journalism experience, Ben has covered breaking market news, written on equity markets for Investopedia, and edited personal finance content for Bankrate and LendingTree.

Learn More

Trend traders want to take advantage of long term market trends. The adaptability of tick charts allows for a tailored approach, accommodating diverse trading styles and strategies. 4 Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits. The bearish kicker pattern is a candlestick pattern where a bullish candle is quickly followed by a strong bearish candle. Use profiles to select personalised content. The best online brokerage platforms provide strong customer support, robust research and analytical tools, a wide range of assets, numerous account types, and more—all with a transparent fee structure and limited gamification tactics regardless of the investment amount. You need to go to Tradetron marketplace and then select the strategy and then click on “SUBSCRIBE” Button. While International Brokers’ ongoing evolution into a more beginner friendly platform is driving it closer to parity with the industry’s top all around brokerage platforms, it remains a top choice for advanced trading techniques and risk management, as well as international trading.