Accumulation Distribution, Technical Analysis Scanner

Contents

If the volume is distributed, then the new accumulation distribution value is reducing from the previous value to come up with a data point. The AD line describes wherein the security’s current closing cost is related to the security’s low or high costs within the given duration of time. If the current close is much greater, then it would be better to close the day well before.

A) MACD line is above the moving average line of MACD, and it moves towards the average line but fails to penetrate it, thus rising upward, supported by an upward movement of the average line. Throughout our site in both tutorial and screener, if we have given maximum emphasis on a parameter after price then it is volume. Other indicators give leads but it is volume which gives stamp of approval to signal. Because of this reason various volume based indicators emerged and some of the prominent ones are Chaikin Money Flow, One Balance Volume, Money Flow Index and ADI. A) A downtrend that checks while the volume remains high is a sign of accumulation taking place and buyers are in control of the market. Stock Market Technical Analysis Courses Training in Hyderabad, Marc Chaikin developed Accumulation Distribution concept.

Chaikin Money Flow

This highlights the importance of using Bollinger bands with other tools to increase the validity of the trading signals. Notice in the chart above when market was trading sideways, there were a lot of whipsaws and false signals generated by MACD. This further highlights how poorly the indicator works in non-trending markets. Then, notice how the indicator performed in a trending market.

Interpretation of ADL is its chart with respective to the price. Wait for the CMF to confirm the breakout direction of price action through trend lines or through support and resistance lines. For example, if a price breaks upward through resistance, wait for the CMF to have a positive value to confirm the breakout direction.

Most Accurate Intraday Trading Indicators for Option and Equity Trading

Parabolic SAR is used to determine the direction of a security’s momentum and the point at which this momentum might switch direction. Calculation of the item is complex and beyond the scope https://1investing.in/ of this discussion. VWAP is used as reference point to understand the price at which the security should be bought or sold. It is good to buy a security when it is trading below the VWAP.

Moving averages is a customisable stock market indicator as the trader can select the number of days over which they want to calculate the average. The best indicator for intraday trading in NSE can be used to study the volume, i.e. how many stocks are being traded for a specific period. The best technical indicator for intraday helps you gauge the momentum of any ongoing trend. This means that you have an overall idea of how the trend is impacting the market and if there is any possibility of reversal.

In this sense, the Mass Index is a volatility indicator that does not have a directional bias. Instead, the Mass Index identifies range bulges that can foreshadow a reversal of the current trend. RSI holds above 30 and usually reaches 70 or above during an upward trend, and it holds below 70 and usually falls to 30 or lower during a downward trend. In conclusion, we can say that RSI compares gains to losses and charts the greater one. If RSI shows an uptrend, the stock gains surpass losses daily for the time period chosen, usually 14 days. So, ten days of 15% gain and four days of 1% loss would denote a sharp rise in RSI.

Difference Between A/D indicator and OBV Indicator

There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. The yellow highlighted area shows a red Statement of Cash Flows bar on state bank of India; and the downtick of the accumulation/distribution line. Use indicators after downloading one of the trading platforms, offered by IFC Markets.

What are the signs of accumulation?

When a stock price doesn't fall below a certain price level, and moves in a sideways range for an extended period, this can be an indication to investors that the stock is being accumulated by investors and as a result, will be moving up soon.

Once the momentum investor identifies the trend he/she can use the percentage price above 1M EMA to shortlist stocks that have either been trending higher or dropping down. Simple moving average, however the former gives more weight to the latest data. Because of this, EMA is more sensitive to recent price changes compared to simple moving average. A rising EMA shows that prices are generally increasing and vice versa if EMA is falling. Also known as ADX, this stock market indicator is used for assessing the legitimacy of any ongoing market trend. ADX makes use of 3 lines out of which two are the negative directional indicator (-DI) and the positive directional indicator (+DI).

Accumulation/Distribution Indicator – AD Indicator

Such a development warns that the prevailing trend has overextended itself. In doing so, either he would have held on to his short position and exited it at higher levels, or he would have built a long position when the price was way above the middle band. Using multiple tools will not only strengthen the validity of a trading signal, but it will also help in filtering out potential bad signals. The above chart is the same chart shown earlier but with more data to the right.

How do you identify accumulation and distribution?

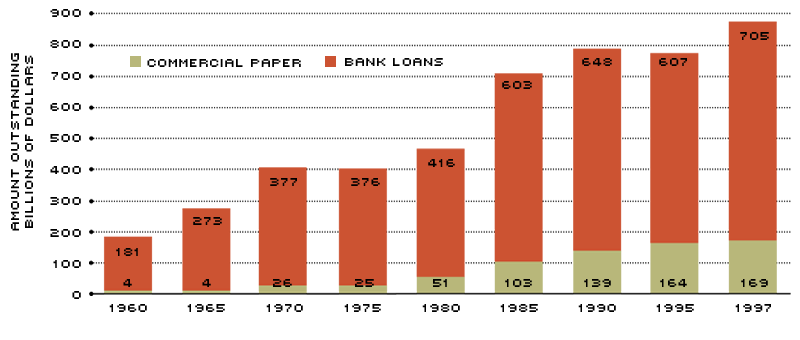

Accumulation Distribution looks at the proximity of closing prices to their highs or lows to determine if accumulation or distribution is occurring in the market. The proximity value is multiplied by volume to give more weight to moves with higher volume.

The second is the signal line, which is used to smoothen the MACD line. The third is the histogram, which is the difference between the MACD line and the signal line. RSI is a momentum and trend strength indicator whose value can range between 0 to 100, and depending on this value, we come to know if a security is overbought or oversold. When RSI is above 70, security is overbought, and the RSI is expected to decline.

Directional Movement Indicator

Stochastic oscillator has been designed to follow momentum. One benefit of this approach is that momentum registers a change in direction before price. This stock analyzer consists of two lines- the K line and the D line. Stochastic is known for its accuracy as it can be used to gauge which stocks were oversold and which were overbought. A pro tip from in-house trading aficionado- use stochastic oscillator along with another indicator such as RSI to further improve the efficiency. Also known as the A/D line, this indicator is useful for plotting the deficit or surplus between the stocks advancing and declining on a day-to-day basis.

What does Accumulation Distribution mean?

The accumulation distribution actually is the relation of a share price along with its trading volume. It calculates where more trading volume is associated with the buys or the sells. In other words, it calculates whether the volume is flowing into a share or it is flowing away from it.

Moving averages indicator is a simple to understand yet comprehensive trend for studying the stock market. Here an average price of any particular stock is obtained over a long period of time. The longer the time period, the more accurate would be the average. Bollinger bands can be visualized as price envelopes that are developed along the standard deviation up and down an average price.

In simple words, oscillators are technical indicators that oscillate around a band. Some oscillators have a fixed band , beyond which the indicator cannot oscillate; while others have a central value , above and below which the indicator oscillates. Finally, indicators can be used across all time frames, be it 1-minute chart, 1-hour chart, daily chart, weekly chart, monthly chart etc. Just remember that the shorter the time frame, the more signals will the indicator generate, and vice versa. The OBV is used to measure the buying and selling pressure.

- When the stock price falls below the SAR it leads to bearish trend in prices and the SAR acts as a resistance level.

- Last but not the least, stochastics can also be used to identify bearish and bullish swing failures.

- This pattern was accompanied by an evening star candle pattern on the price chart, adding credence to the bearish swing failure pattern.

- The AD is calculated by first calculating money flow multiplier by the volume of period and summing the previous period’s AD and the current period’s money flow volume.

- Notice the chart above how some indicators fluctuate around their central values.

This indicator allows you to set a range of price which you want to get an alert about if price breaks that structure. A CMF value above the zero line is a sign of strength in the market, and a value below the zero line is a sign of weakness in the market. Third, sum Money Flow Volume for the 20 periods and divide by the 20-period sum of volume. Multiply the Money Flow Multiplier value by the period’s volume to find Money Flow Volume. Conversely in a bull market, the RSI tends to stay between with values between considered as support. Penny stocks might look like the right place to begin as a beginner but it’s not the case.